Many people seem to believe that the Eurozone’s monetary

problems, caused by economic over-regulation and intervention (e.g. the

common currency), can be solved by imposing even more regulation and

intervention (e.g. fiscal integration).

But what kind of track record do governments really have when it comes to manipulating the fundamentals of the real economy?

It Is Not Just the Euro…

Whilst the impact of fiscal policy is rather contemporary, the use of

monetary policy as medicine to improve economic health has long-term

implications, comparable to the side-effects of substance abuse. There

are numerous examples of how government’s manipulation of money flows

and exchange rates has lead to short-term economic euphoria (usually

correlated with election cycles), but at the cost of creating long-term

imbalances that end up being reversed with a significant element of

social stress.

For example:

- The credit bubble leading up to the Great Depression of the 1930s

was created by the US trying to help the UK keep the gold standard after

World-War 1. The Fed bought British pounds with freshly issued US

dollars, which increased the US money supply (creating a lending driven

economic boom, leading to debt levels which, though large in size, were

still smaller than what can be observed in the global economy today

before the economy reversed)

- The crisis in Latin America in the early 1980s was similarly the

result of currencies initially being pegged to the USD, driving up

domestic money supply, creating negative real interest rates leading to

huge debt imbalances (in USD)

- The Japanese real estate bubble between 1986-1991 (which Japan

still has not recovered from) was the result of a lending spree

occurring because the Japanese pegged their currency to the USD to

stimulate their export industry (the central bank had to print Yen to

buy USDs, which increased the domestic money supply and kept real

interest rates in negative range)

- The Asian Crisis (1997) was also the result of an initial USD peg

among a select group of Asian economies, which lead to unsustainable

inflation, asset bubbles and debt levels

- The pegging of the Dirham to the USD lead to too lax monetary

policies which gave fuel to a massive real estate bubble in the United

Arab Emirates that pricked in 2009 (prior to that, real interest rates

where in negative range for about 7 years). The UAE was able to keep its

peg due to significant oil revenues, however is still struggling with

the aftermath of high inflation

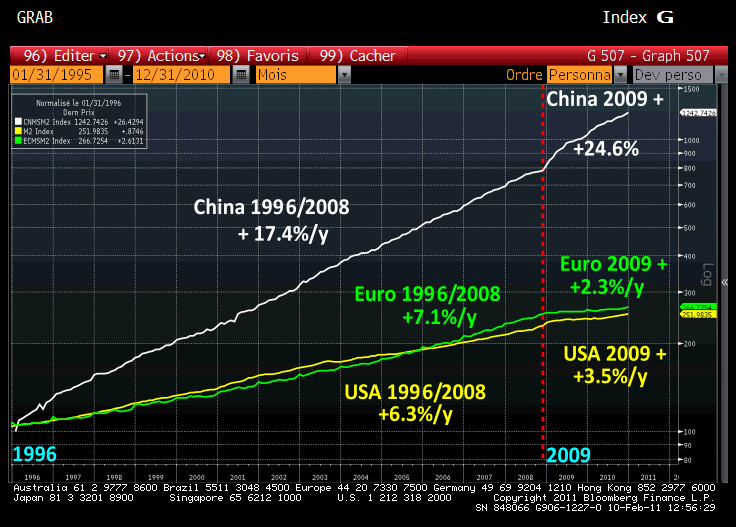

- Now China is overheating with inflation because it cannot control

its money supply as the result of the USD peg. Inflation is at 6.5% and

real interest rates have been negative for a long time. China may need

to de-peg sooner rather than later, if it does not do so, it is risking

further build up of an asset bubble that threatens economic stability. A

de-peg will inevitably lead to a USD collapse, potentially creating

double digit US inflation almost overnight and putting further strains

on the Eurozone as exports will become massively uncompetitive – to come

on top of the zone’s already huge structural problems.

And the list can go on and on….

A Change of Paradigm

A crisis yet to come is founded in the widely celebrated central bank

interventions from Greenspan and the Fed. They have succeeded only in

postponing major economic re-adjustments which have been overdue since

the 1990s.

Through counter cyclical monetary policies during what initially must

have been smaller recessions (which technically are nothing but

temporary periods of lower economic growth due to businesses and

consumers re-paying debt instead of consuming and investing), the Fed

decided to cure the symptoms experienced by having too much debt (e.g.

low growth) by lowering interest rates, which stimulated even more debt.

With progressively lower interest rates, consumers kept the economy

growing by consuming with borrowed funds, and debt has increased to

levels never before seen in history (US public and private sector is

debt is now close to an astonishing 260% of GDP, roughly quadrupled

since 1982, and around 50% higher than before the Great Depression).

And when the private sector in 2008 eventually was unwilling to

continue their loan financed consumption spree (even with interest rates

close to 0%!), borrowing (and spending) was instead taken over by the

US government, sold to the public as “Keynesian counter cyclical fiscal

expansion”.

The Fed’s overly expansive monetary policy of the late 1980s, 1990s

and throughout the 2000s, has not only created a massive debt overhang,

but have also sustained artificially high domestic GDP growth rates

(driven by the debt fueled consumption) and supported global confidence

in the USD as a reserve currency. The rest of the world believing in the

“almost supernatural” powers of the Fed (remember the t-shirts saying

“in Greenspan we Trust”?) has contributed to overvaluing the USD vs the

currencies of trading partners. This has in turn driven the US from

being a manufacturing driven economy focused on production to a service

driven economy focused on consumption (to put it simply, US cars became

too expensive to produce, so people found work at Burger King instead).

Throughout all this time, the US public accepted the structural

economic shift towards low-earning service sector jobs, as they were

still able to keep consuming, financed by the progressively cheaper

credit.

Back in the really old days “bread and circus” used to do the trick. Today it is all about “iPhones and Playstations”.

Greenspan was by some declared genius, but truth is that the policies

undertaken by the Fed under his management have probably damaged the US

economy more than ten nuclear disasters or a hundred terrorist attacks.

The Fed has acted similar to a doctor prescribing more heroin to cure abstinence symptoms stemming from heroin abuse.

As time goes, the patient develops increased tolerance and needs higher

and higher dosages to feel good. The last dosages administered are so

extreme that they impose a threat to his life, and though no-one expects

them to cure him, at least he may have a final hell-of-a-party before

he must face the real underlying sources to his pain (that is, if he is

lucky enough to survive. More about that in a previous article, “The

Inflation Storm”).

Convergence to Normality

Today’s 40-year old fiat currency regime is only a blip in economic

monetary history (spanning back thousand of years) and will soon make

way for the next paradigm shift, which may well be a return to the gold

standard and the abolishing of how central banks work today.

Central banks started out as simple reserve banks to ensure stability

of commercial banks (which issued gold certificates, at the time the

equivalent of money).

Somehow, potentially deluded by perceived progress of economic theory

(or simply a case of bad memory following 30 years of post WW2

stability), their mandates grew to encompass tasks requiring superhuman

wisdom, divine integrity and foresight…

Before we return to sanity, the next economic paradigm will be a bearparadigm.