Time to put money where the mouth is.

Today it is November 11, 2012 and here are some indicators on the economic health of the world, how they will be affected the next 2-3 years by the ongoing QE 3 and why.

Apple stock: USD 547 per share. Short, 50% of capital at risk.

Google stock: USD 663 per share. Long, 50% of capital at risk (balancing Apple short position).

Bank of America stock: USD 9.43 per share. Long, 50% of capital at risk.

Physical gold: USD 1735/ ounce. Long, 50% of capital at risk.

Note that the total sum of the portfolio weights are 100%.

Rationale

Apple: Inflation will increase production cost faster than Apple can raise prices, putting pressure on margins. Also, Apple's applications are becoming commoditized by competition and iOS will never (ever) evolve to become the industry standard (such as Windows has been for PC) as Apple is making the mistake of limiting it to own devices only.

Google: The company is service based (excluding Motorola) and can thus easily adjust prices to match its cost base in a high inflation scenario. From a fundamental point of view, the company is well positioned to gain exposure to fast growing service segments such as iCloud services and is in the position to cannibalize the business models of Facebook, Linked-in, PayPal, Skype and Amazon, through interaction/cross sell to its Gmail user base (the largest/ most popular web-based e-mail application in the world). Further spread of the Android operating system (penetrating increasingly cheaper devices and alternative applications, such as TVs, MP3 players, car stereos, digital watches etc) will provide additional channels for its advertising business and boost income from the Google Play store. It also has proven to have the ability to compete in the hardware segment through clever partnering - Nexus 7 and Nexus 4 are currently the best value for money buys within 7' tablets and 4' smartphones, respectively.

Bank of America: A bank is a service intermediary. It can easily mitigate higher costs (e.g. borrowing interest rates) by raising prices (lending interest rates). It is sensitive to opex increases due to high cost/income ratio, but in a high inflation scenario, salaries will grow slower than income as most of the inflationary pressure is created outside the domestic economy through commodity price increases. The banks balance sheet will increase faster than the money supply, as the velocity of money picks up when consumers start borrowing again, expecting further prices increases in real assets. Furthermore, BoA is one of the largest banks in America, and size matters in banking, due to huge synergies in the utilization of IT systems, diversification of risk and corresponding lower funding cost. Bank of America is trading at a Price to Book ratio of around 0.45. A fairly valued large bank should be trading around 1.2-1.5.

Physical gold: QE 3 is primarily creating inflation in countries that have pegged their currencies to the USD, and only secondary in the US, due to continued surplus supply in the labor market (8% unemployment is still above the 5-7% equilibrium unemployment rate). Some of these countries (India and China in particular, together with more than 40% of global gold demand) have long traditions for saving in gold. As incomes continue to increase in China, India, Brazil, SE Asia, etc, so will the long-term demand for gold in these countries.

Money & inflation - opportunities, risks, and the eventual shift of currency paradigm

Sunday, November 11, 2012

Thursday, October 18, 2012

US housing starts at record highs -

In my lengthy post from September 2011 (The "Inflation Storm", initially posted on bearparadigm.com, now discontinued, but re-published on this site, below) I assigned a high probability to the US housing market would turning in 2012.

The housing market has now turned. September 2012 building starts are the highest in 4 years, and house prices have increased about 2.2% in the second quarter of 2012 (up 1.2% year on year, according to the Case-Schiller index).

With the Fed recently mandated to buy $40 billion of mortgage backed obligations per year, this is likely to continue. Banks have massive un-used ability to lend and the velocity of money (how fast new funds trickle into the economy) is at an all time low (see the below chart).

With housing prices now poised to rise at rates that are higher than the cost of financing, funds will continue to be deployed in the housing market, driving up prices, creating expectations concerning future price increases etc. Unemployment (latest figures reported at 7.8%) will continue to decline as the construction sector picks up, and consumer credit grows again. If the US government can continue to finance (and increase) its debt burden, 2013 may be a boom year, instead of the depressing recession currently predicted by so many (Nouriel Roubini, Jim Rodgers etc). T-bonds and T-bills have yields at all-time lows, so it seems like the market (e.g. the Chinese central bank, sovereign wealth funds etc) are willing to do just that.

Many people have been predicting US hyperinflation since year 2000, the voices becoming stronger and stronger over the years. However, in spite of massive monetary increases by the Fed, inflation has failed to materialize. The divergence from the historic relationship between domestic monetary supply increases and inflation is due to the massive US' trading deficit versus the rest of the world, and the strong interest of major national governments to keep their currencies pegged to the US dollar. This factor is completely overlooked by most economic commentators.

The future welfare of US citizens is as such in the hands of Chinese policymakers. Luckily for them, both the US and China have an interest in allowing for the imbalances to continue, as correcting them would imply a painful restructuring in both economies, inevitably leading to social un-rest and regime changes. A prediction of hyperinflation in the US (which can easily materialize) thus becomes a question of game-theory more than anything else.

It is clear however, that the imbalances at some point must be corrected. The larger they become, the more painful the correction will be. The most likely trigger is inflation in countries with currencies pegged to the USD coming out of control, which is already happening; food prices are increasing all over the world, certain metal prices are near all-time highs. Rising food prices have the potential of toppling regimes everywhere; they were a significant factor in motivating the public during the Arab Spring, just as they were during the French revolution in 1789.

The housing market has now turned. September 2012 building starts are the highest in 4 years, and house prices have increased about 2.2% in the second quarter of 2012 (up 1.2% year on year, according to the Case-Schiller index).

With the Fed recently mandated to buy $40 billion of mortgage backed obligations per year, this is likely to continue. Banks have massive un-used ability to lend and the velocity of money (how fast new funds trickle into the economy) is at an all time low (see the below chart).

With housing prices now poised to rise at rates that are higher than the cost of financing, funds will continue to be deployed in the housing market, driving up prices, creating expectations concerning future price increases etc. Unemployment (latest figures reported at 7.8%) will continue to decline as the construction sector picks up, and consumer credit grows again. If the US government can continue to finance (and increase) its debt burden, 2013 may be a boom year, instead of the depressing recession currently predicted by so many (Nouriel Roubini, Jim Rodgers etc). T-bonds and T-bills have yields at all-time lows, so it seems like the market (e.g. the Chinese central bank, sovereign wealth funds etc) are willing to do just that.

Many people have been predicting US hyperinflation since year 2000, the voices becoming stronger and stronger over the years. However, in spite of massive monetary increases by the Fed, inflation has failed to materialize. The divergence from the historic relationship between domestic monetary supply increases and inflation is due to the massive US' trading deficit versus the rest of the world, and the strong interest of major national governments to keep their currencies pegged to the US dollar. This factor is completely overlooked by most economic commentators.

The future welfare of US citizens is as such in the hands of Chinese policymakers. Luckily for them, both the US and China have an interest in allowing for the imbalances to continue, as correcting them would imply a painful restructuring in both economies, inevitably leading to social un-rest and regime changes. A prediction of hyperinflation in the US (which can easily materialize) thus becomes a question of game-theory more than anything else.

It is clear however, that the imbalances at some point must be corrected. The larger they become, the more painful the correction will be. The most likely trigger is inflation in countries with currencies pegged to the USD coming out of control, which is already happening; food prices are increasing all over the world, certain metal prices are near all-time highs. Rising food prices have the potential of toppling regimes everywhere; they were a significant factor in motivating the public during the Arab Spring, just as they were during the French revolution in 1789.

Thursday, October 11, 2012

Bad Bank in Spain - so far just window dressing.

On October 3rd, the Spanish government announced the implementation of a Bad Bank in December, to relieve domestic banks of their toxic real estate assets.

The model was successfully applied in Sweden and Norway in aftermath of the 1992 banking crises, which followed during a period of collapse in real estate markets. The implementation of a Bad Bank allowed for the restoration of the balance sheets of banks, with two distinct benefits:

1. Removing the risk of a systematic collapse should one of them fail, and;

2. Allowed the countries' banks to lend out to deserving companies and individuals again.

Though the concept of a Bad Bank as has historic evidence that it can be an effective initiative for restoring credit market liquidity and reducing risk, there are some significant differences that imply the Spanish initiative is nothing more than window-dressing:

1. The banks' equity exposure to the transferred assets continue to exist, just now in the form of an equity stake in the Bad Bank, so it does not completely de-risk the banking sector.

2. Investor's capital outlay's into the Bad Bank cannot be recovered by a future sale of equity of the restructured banks.

3. Transfer of assets will most likely NOT happen at market prices, as doing this will erode capital adequacy ratios for the banks, trigger re-financing.

The currently proposed structure is a political compromise (or a result of the bank's bribing the policy makers?) designed to protect the interest of the country's wealthy, with (again!) Northern European tax-payers paying the price in the form of higher inflation (only financing available is printed money from ECB).

The model was successfully applied in Sweden and Norway in aftermath of the 1992 banking crises, which followed during a period of collapse in real estate markets. The implementation of a Bad Bank allowed for the restoration of the balance sheets of banks, with two distinct benefits:

1. Removing the risk of a systematic collapse should one of them fail, and;

2. Allowed the countries' banks to lend out to deserving companies and individuals again.

Though the concept of a Bad Bank as has historic evidence that it can be an effective initiative for restoring credit market liquidity and reducing risk, there are some significant differences that imply the Spanish initiative is nothing more than window-dressing:

- In Norway and Sweden in the 1990s, shareholder equity in distressed banks was nulled with shareholders loosing all of their investments. Bond-holders were the only ones protected. After the banks had been restructured and were showing profits again, government capital outlays were recovered by re-privatizing the banks.

- The Bad Bank was funded with public sector money. The transfer of assets to the Bad Bank happened at market rates. There was a minimal element of negotiation between the Bad Bank and the bankrupt banks; as all entities became government owned they had the same shareholder. Bankrupt commercial banks were re-capitalized by the government only to regain sufficient capital adequacy ratios.

1. The banks' equity exposure to the transferred assets continue to exist, just now in the form of an equity stake in the Bad Bank, so it does not completely de-risk the banking sector.

2. Investor's capital outlay's into the Bad Bank cannot be recovered by a future sale of equity of the restructured banks.

3. Transfer of assets will most likely NOT happen at market prices, as doing this will erode capital adequacy ratios for the banks, trigger re-financing.

The currently proposed structure is a political compromise (or a result of the bank's bribing the policy makers?) designed to protect the interest of the country's wealthy, with (again!) Northern European tax-payers paying the price in the form of higher inflation (only financing available is printed money from ECB).

Wednesday, September 19, 2012

Bernanke is creating inflation....in China (part 2)

This is the real chart I should have used in the previous post, it illustrates my point. It is taken from the blog of someone who thinks that the "money multiplier is dead" (Cullen Roche at PragCap.com).

His observation does not account for how the US Current Account deficit (and the Chinese dollar peg) impacts the relationship between the policies of the Fed, US monetary supply and inflation.

His observation does not account for how the US Current Account deficit (and the Chinese dollar peg) impacts the relationship between the policies of the Fed, US monetary supply and inflation.

Tuesday, September 18, 2012

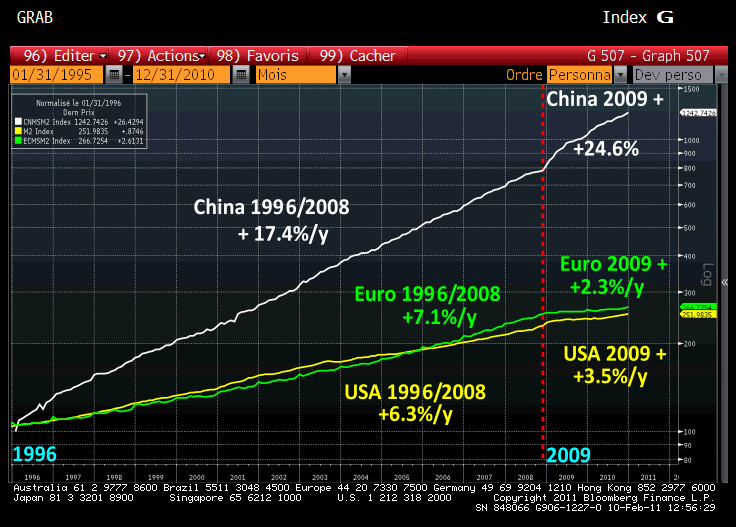

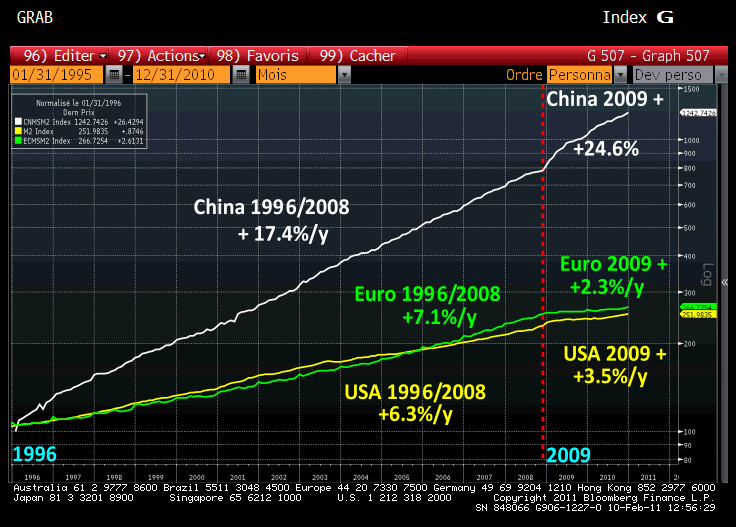

Bernanke is creating inflation... in China

This chart says it all (or if not all, at least quite a lot):

It is showing the US M1 money supply versus the price of gold. Interestingly, the oil price is showing a similar relationship, however less succinct in the very recent years, as oil has been substituted for alternative energy sources in developed economies. Since year 2000, the correlation has become much more distinct. It is worth noting, that in the decade before year 2000, the US Current Account deficit was about 1% of GDP on average. In the decade following year 2000 (and to date), the US Current Account deficit has averaged around 5% of GDP.

As shown in my post "the inflation storm", a high Current Account deficit means that the money is Fed printing is going out of the domestic economy, and in the first instance creates inflation elsewhere. Particularly in trade-able global commodities (such as oil, gold, wheat etc), but also to general wage inflation in countries that have massive trade with the US and dollar based currencies though the maintenance of some kind of USD peg (about 80% of global money stock is somehow dollar based, as discussed in "the inflation storm"). The inflation is then imported back to the US in the form of higher energy prices, higher production prices and higher food prices.

QE 3 will continue creating inflation in China, India, Gulf states etc, until these countries break their USD peg (when that happens, the US may experience hyperinflation almost overnight), or become less competitive due to increasing domestic wages, thus reducing the Current Account deficit due to exporting less. However, wages are still so low, and there is considerable room for labor productivity improvements in these economies (as the economies become richer, their population becomes more educated, thus more productive), that it will take at least 30 years before this happens. Due to election cycles on average being only 4 years, politicians' interests diverge from the long-term interest of the public (whose understanding of economics is nil anyway), and nothing will be done to prevent what eventually will be an economic disaster unlike anything the world has ever seen. As the response of global policy makers will be to continue the use of monetary stimuli, the value of fiat money will continue to diminish. The world will not reach stability again until global trade can be re-established through a re-introduction of the gold standard. This will be done at a purchasing power value of gold that will be much much higher than today. Before it happens, we will see all kind of policy measures being tested, such as price controls, trade restrictions etc which will do nothing but reducing economic efficiency, leading to more monetary stimuli to combat unemployment etc.

We are only seeing the beginning of the end. Meanwhile, one should question the intelligence and foresight of investors taking long-term hold positions in US fixed income. Mad or stupid, they have no excuse.

It is showing the US M1 money supply versus the price of gold. Interestingly, the oil price is showing a similar relationship, however less succinct in the very recent years, as oil has been substituted for alternative energy sources in developed economies. Since year 2000, the correlation has become much more distinct. It is worth noting, that in the decade before year 2000, the US Current Account deficit was about 1% of GDP on average. In the decade following year 2000 (and to date), the US Current Account deficit has averaged around 5% of GDP.

As shown in my post "the inflation storm", a high Current Account deficit means that the money is Fed printing is going out of the domestic economy, and in the first instance creates inflation elsewhere. Particularly in trade-able global commodities (such as oil, gold, wheat etc), but also to general wage inflation in countries that have massive trade with the US and dollar based currencies though the maintenance of some kind of USD peg (about 80% of global money stock is somehow dollar based, as discussed in "the inflation storm"). The inflation is then imported back to the US in the form of higher energy prices, higher production prices and higher food prices.

QE 3 will continue creating inflation in China, India, Gulf states etc, until these countries break their USD peg (when that happens, the US may experience hyperinflation almost overnight), or become less competitive due to increasing domestic wages, thus reducing the Current Account deficit due to exporting less. However, wages are still so low, and there is considerable room for labor productivity improvements in these economies (as the economies become richer, their population becomes more educated, thus more productive), that it will take at least 30 years before this happens. Due to election cycles on average being only 4 years, politicians' interests diverge from the long-term interest of the public (whose understanding of economics is nil anyway), and nothing will be done to prevent what eventually will be an economic disaster unlike anything the world has ever seen. As the response of global policy makers will be to continue the use of monetary stimuli, the value of fiat money will continue to diminish. The world will not reach stability again until global trade can be re-established through a re-introduction of the gold standard. This will be done at a purchasing power value of gold that will be much much higher than today. Before it happens, we will see all kind of policy measures being tested, such as price controls, trade restrictions etc which will do nothing but reducing economic efficiency, leading to more monetary stimuli to combat unemployment etc.

We are only seeing the beginning of the end. Meanwhile, one should question the intelligence and foresight of investors taking long-term hold positions in US fixed income. Mad or stupid, they have no excuse.

Monday, September 17, 2012

It is called convergence....

It is September 2012:

One in seven Americans is depending on food stamps for survival.

Real US unemployment has hit about 16% (work-force participation is just 64%), in spite of official statistics showing unemployment have come down to about 8.1%

Median US household income has dropped from $55,470 in January 2000 to $50,964 in August 2012.

Simultaneously, according to official statistics, prices have increased 34% over the same period.

Apple's market capitalization is hoovering around $ 650 billion, making it the largest company by market value in the world.

Gold is trading around $ 1,770 per ounce, oil is at $99 a barrel.

Just 10 years ago, very few would think the above possible. What is going on?

In one word: "Convergence".

Or more precisely: Economic convergence between trading economies. Shortly put; because wages are lower in China, manufacturing continues to move to China, and will do so until Chinese labor becomes so expensive that it is more profitable to produce elsewhere. The prime catalyst of convergence has been the wide-spread roll-out of efficient information infrastructure.

In plain language - internet access and electronic data interfaces are enabling global supply chains and disrupting traditional economic patterns as producers and consumers find new, efficient ways of transacting. The lessons learned for developing nations still struggling with growth should be obvious: Focus on supplying the enablers - electricity (particularly for Africa) and access to the internet (Africa, Cuba, Burma etc). If you on top of that can maintain political and monetary stability, just lean back and wait for growth to follow.

Convergence benefits investors and foreign labor (e.g. consumers) in the country of production, and hurts local labor (e.g. consumers) that have skills that can easily be substituted. Apple would not be able to sustain a 50% profit margin on every iPhone and iPad sold, had it not been for cheap Chinese labor and cheap Chinese components. Foxconn, the assembler of Apple devices, employs 1.2 million people. If considering component manufacturing and subsequent value chain activities, Apple probably contributes to somewhere in the range of 3-5 million Chinese jobs.

And this is just Apple. HP, Dell,GE AT&T, etc are all American companies with substantial impact on Chinese employment. As they have shifted production to China, jobless Americans have found lower paying jobs at McDonald's, maintaining their ability to spend with borrowed money, leading to today's over-leveraged consumer

However, consumers (also US consumers) all want affordable products. So as outsourcing and trade leads to efficiency gains, it is for the greater good, right?

Not quite...

One in seven Americans is depending on food stamps for survival.

Real US unemployment has hit about 16% (work-force participation is just 64%), in spite of official statistics showing unemployment have come down to about 8.1%

Median US household income has dropped from $55,470 in January 2000 to $50,964 in August 2012.

Simultaneously, according to official statistics, prices have increased 34% over the same period.

Apple's market capitalization is hoovering around $ 650 billion, making it the largest company by market value in the world.

Gold is trading around $ 1,770 per ounce, oil is at $99 a barrel.

Just 10 years ago, very few would think the above possible. What is going on?

In one word: "Convergence".

Or more precisely: Economic convergence between trading economies. Shortly put; because wages are lower in China, manufacturing continues to move to China, and will do so until Chinese labor becomes so expensive that it is more profitable to produce elsewhere. The prime catalyst of convergence has been the wide-spread roll-out of efficient information infrastructure.

In plain language - internet access and electronic data interfaces are enabling global supply chains and disrupting traditional economic patterns as producers and consumers find new, efficient ways of transacting. The lessons learned for developing nations still struggling with growth should be obvious: Focus on supplying the enablers - electricity (particularly for Africa) and access to the internet (Africa, Cuba, Burma etc). If you on top of that can maintain political and monetary stability, just lean back and wait for growth to follow.

Convergence benefits investors and foreign labor (e.g. consumers) in the country of production, and hurts local labor (e.g. consumers) that have skills that can easily be substituted. Apple would not be able to sustain a 50% profit margin on every iPhone and iPad sold, had it not been for cheap Chinese labor and cheap Chinese components. Foxconn, the assembler of Apple devices, employs 1.2 million people. If considering component manufacturing and subsequent value chain activities, Apple probably contributes to somewhere in the range of 3-5 million Chinese jobs.

And this is just Apple. HP, Dell,GE AT&T, etc are all American companies with substantial impact on Chinese employment. As they have shifted production to China, jobless Americans have found lower paying jobs at McDonald's, maintaining their ability to spend with borrowed money, leading to today's over-leveraged consumer

However, consumers (also US consumers) all want affordable products. So as outsourcing and trade leads to efficiency gains, it is for the greater good, right?

Not quite...

There are at least three main challenges with this development:

1. Though trade generally leads to efficiency gains, the current trade balance is unsustainable, as US consumers ability to consume is enabled by China (and others) continuing to finance the US consumer (and government) with debt. As the Fed is effectively printing money to support government finances, it will erode the value of the dollar, and China and others will eventually shift their holdings to other assets, such as gold (they already have).

2. The large part of the work-force that is without a job does not contribute to economic development (this is called an "output gap" in economic terms), and their human capital is deteriorating, as they are unable to find jobs even at lower wages. As it will still take decades before Chinese and US wages have converged, future Chinese wage catch up may still leave little hope, as the US will then have a large pool of labor that has been out of the workforce for so long that they may never regain their past productivity.

3. The collective feeling of becoming poorer will widen feelings of dissatisfaction among the general public and eventually lead to social unrest, crime and instability. The US will move onto the path followed by several Latin American countries, where slums are existing next to middle class neighborhoods, crime and kidnappings are prevalent, and barb wire and guns are key to separate those who have from the have-nots.

For the record, this is not just a US problem. The Euro has also been kept artificially high by Asian central banks' currency purchases, painfully contributing to the economic difficulties experienced in the periphery of the Euro zone, where wages are relatively low in absolute terms, but still way too high to attract capital for investments when considering the full cost of doing business; corruption, inefficient and obstructive government, rigid labor laws and high taxes. Unlike in the US, real wages have so far not declined notably during the recession. What we are experiencing is not just a temporary recession that can be influenced by fiscal and monetary stimuli, it is the beginning of a paradigm shift that will influence the world for the next 50 years.

So, if this is the general direction, how-come the US Congress cannot decide on actions to prevent it?

US Congress are mainly capital holders with significant assets under management (an average net worth of USD 6 and 13 million for members of the House of Representatives and Senate, respectively). Most of them own businesses and/or (for example) Apple stock. As US labor cost come down, capital returns increase, and US companies with outsourced production also become more profitable. And since they consume the same amount of basic goods as every other American, they do not feel the pain of food and gas inflation. They are likely to allow for the trend to continue until it becomes unsustainable, and the society collapses as a whole, threatening property rights, and the value of their cash holdings disappear as it is inflated away.

There is anyway not much they can do, without going back to a gold based currency (preventing the Fed from printing money in response to Asian demand for their currency) they cannot change the fundamental flaw which has allowed for these imbalances to occur. And the economy is still far from reaching the point where this can be done yet - a major collapse must (and will) happen first.

Subscribe to:

Posts (Atom)