The key question is, has the gold price reached a bottom, or is it close to forming a bottom?

As shown by the below table (courtesy of the World Gold Council), the only ones who have been net sellers in q1 2013 (the key players in driving the gold price down) are the aforementioned ETFs.

With industrial demand stable and all other sources of demand increasing, the key question then becomes, can the ETF sell-off continue?

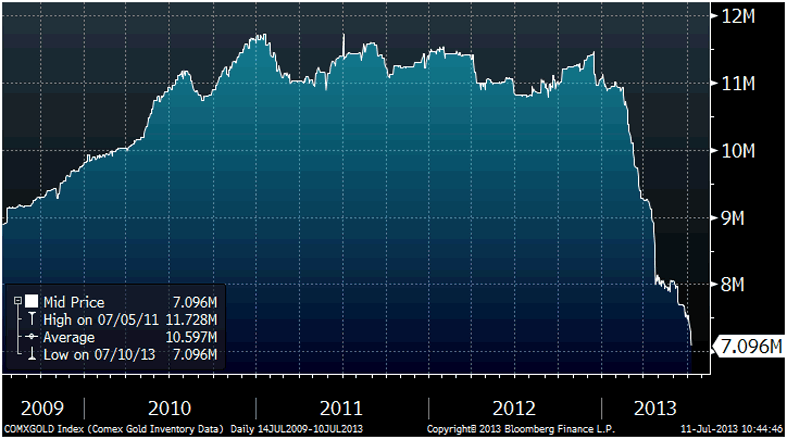

The below chart is showing the inventory of gold in COMEX vaults, which is where many professional investors store their gold (courtesy of Bloomberg finance).

As seen from the chart, inventory reduction since December 2012 corresponds to 4.5 million ounces, or close to 140 tonnes of gold. Though this is slightly less than half of total ETF sales since December, it gives a good indication of how much gold stock there is left to supply to the market.

As the chart only provides data until end of May 2013 (and we've had another month of net sell-offs), current inventory levels are likely to be around 6-6.5 million ounces, e.g. they are at the same levels as they were in 2004.

This has several implications:

- A sell-off of the same magnitude in the next 6 months becomes impossible, as this will take ETF inventory levels to 0.

- A continued sell-off must therefore occur at lower volumes. It is therefore highly unlikely that prices will come much further down, as the market has been able to absorb the massive volumes supplied by the ETFs, with only modest price declines (yes, in my book, a 30% decline for a commodity with this magnitude of sell-offs of is modest)

- There is huge upside in gold once the sell-off is completed. As ETFs are momentum buyers (the public is always displaying herd mentality and are following the trend), they will return to gold once the prices stop dropping. It is key to note, that the market was clearing around the $1700/oz level before the ETF sell-off started.

As mentioned in a previous article, the gold price is not mainly determined by the sentiment of the American public, at least not in the long run. It is driven by wage inflation in Asia and other economies where people either do not trust the local banking system (India) or want to store their wealth in assets that are hidden from the eyes of the local authorities (China). Nevertheless, ETFs provide the residual demand and supply that gives the gold price extra volatility. American inflation is therefore not a requirement to support the gold price, but is the trigger that will reignite price momentum once it takes place.

No comments:

Post a Comment