I would expect September to see a reversal of the AAPL price move (perhaps down to around $450), with a continued surge in gold. GOOG and BAC are likely to remain flat or slightly decline as long term interest rates continue their climb, increasing the discount factor used by financial analysts.

Money & inflation - opportunities, risks, and the eventual shift of currency paradigm

Thursday, August 29, 2013

Portfolio update

The model portfolio has shown some retreat from peaking at 40% returns in May.

The retreat is mainly due to Apple shares surging, reducing gains on the AAPL short position. BAC has been gaining, whilst GOOG has been showing some signs of retreat. The AAPL short position still provides a good hedge for the GOOG long position, though further declines in AAPL are likely to experience less momentum as the entire stock market is held up by quantitative easing.

I would expect September to see a reversal of the AAPL price move (perhaps down to around $450), with a continued surge in gold. GOOG and BAC are likely to remain flat or slightly decline as long term interest rates continue their climb, increasing the discount factor used by financial analysts.

I would expect September to see a reversal of the AAPL price move (perhaps down to around $450), with a continued surge in gold. GOOG and BAC are likely to remain flat or slightly decline as long term interest rates continue their climb, increasing the discount factor used by financial analysts.

Monday, July 15, 2013

Is the price of gold manipulated?

It is highly possible. In a paper market where no physical

delivery is required, one can simultaneously buy and sell gold. E.g. if I am

a large bank or a hedge fund (or the United States government, as certain gold bulls seem believe) and I want to keep the price

down, I open two (or more) accounts and I trade between these at times when the

market is highly illiquid (e.g. when I can easily sell to myself without

interference).

This type of manipulation is often seen attempted in the

stock market, where it it has to be done repeatedly to drive the price movement

for a stock (for this reason, stock exchanges are monitoring the

counter-parties for trades using sophisticated algorithms, so don’t try this at

home…). In the market for gold, it only needs to be done from time to time, as

stop-losses and margin calls on leveraged positions will escalate a downward

(or upward) move.

However, it is key to note that it only works when the

market is illiquid (you need fill your buy order simultaneously with your sell

order in order to avoid losses). This may explain why the recent sell off in

gold was initiated with a large sell order placed in the middle of the night when

market liquidity was at its lowest (the worst possible timing for a profit

maximizing seller), triggering the first leg down in the gold decline to $1321/

oz in April this year.

Nevertheless, unless the manipulation in the paper market is

successful in amending the price expectations players of the physical market,

it is doomed to be short-lived. The corresponding dynamic will be that demand

for physical gold will explode (and yes, we have certainly seen that

happening), eventually creating a gap between those contracts that allow for

physical delivery and those that don’t.

I tend to believe that the April price move was not

government manipulation, but rather a large hedge fund (most likely Goldman Sachs) who had figured out where most of the stops in the market were,

and saw the opportunity to profit from a short-position by pushing the market

lower. It has subsequently succeeded in scaring the lights out of retail

investors, who are liquidating their ETF holdings, and changing the American

and European market sentiment for gold.

At least for now.

Price of gold manipulated?

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

Price of gold manipulated?

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

Price of gold manipulated?

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

Price of gold manipulated?

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

It is highly possible. In a paper market where no physical delivery is required, one can simultaneously buy and sell gold. E.g. if I am the government (or a large bank or a hedge fund) and I want to keep the price down, I open two (or more) accounts and I trade between these at times when the market is highly illiquid (e.g. when I can easily sell to myself without interference).

This type of manipulation is often seen attempted in the stock market, where it it has to be done repeatedly to drive the price movement for a stock (for this reason, stock exchanges are monitoring the counter-parties for trades using sophisticated algorithms, so don’t try this at home…). In the market for gold, it only needs to be done from time to time, as stop-losses and margin calls on leveraged positions will escalate a downward (or upward) move.

However, it is key to note that it only works when the market is illiquid (you need fill your buy order simultaneously with your sell order in order to avoid losses). This may explain why the recent sell off in gold was initiated with a large sell order placed at the point in time when market liquidity was at its lowest (the worst possible timing for a profit maximizing seller), triggering the first leg down in the gold decline to $1321/ oz in May this year.

Nevertheless, unless the manipulation in the paper market is successful in amending the price expectations players of the physical market, it is doomed to be short-lived. The corresponding dynamic will be that demand for physical gold will explode (and yes, we have certainly seen that happening), eventually creating a gap between those contracts that allow for physical delivery and those that don’t.

I tend to believe that the April price move was not government manipulation, but rather a large hedge fund (most likely close to Goldman Sachs) who had figured out where most of the stops in the market were, and saw the opportunity to profit from a short-position by pushing the market lower. It has subsequently succeeded in scaring the lights out of retail investors, who are liquidating their ETF holdings, and changing the American and European market sentiment for gold.

At least for now.

- See more at: http://www.visualcapitalist.com/what-is-the-cost-of-mining-gold#comment-15533

Sunday, July 14, 2013

Doubling down on Gold? Sell-offs are about to reside.

Gold is currently trading at $1280 per ounce. The price has been pushed down after continued sell-offs by Exchange Traded Funds.

The key question is, has the gold price reached a bottom, or is it close to forming a bottom?

As shown by the below table (courtesy of the World Gold Council), the only ones who have been net sellers in q1 2013 (the key players in driving the gold price down) are the aforementioned ETFs.

With industrial demand stable and all other sources of demand increasing, the key question then becomes, can the ETF sell-off continue?

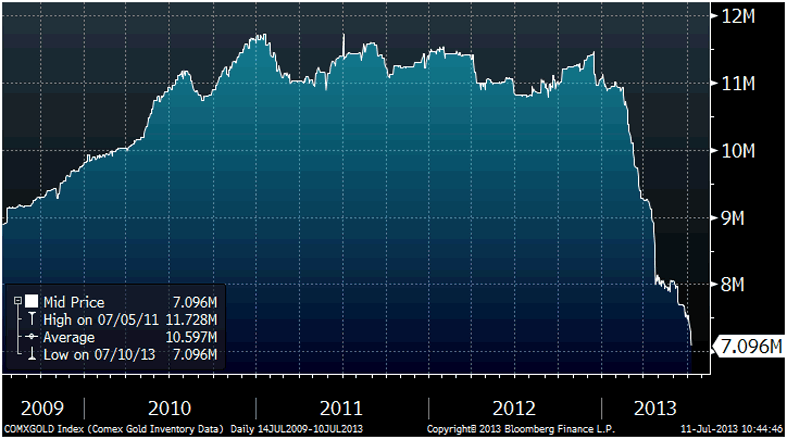

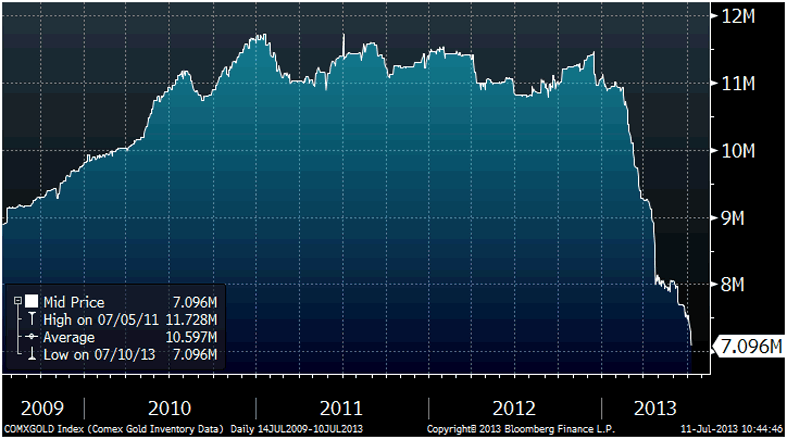

The below chart is showing the inventory of gold in COMEX vaults, which is where many professional investors store their gold (courtesy of Bloomberg finance).

As seen from the chart, inventory reduction since December 2012 corresponds to 4.5 million ounces, or close to 140 tonnes of gold. Though this is slightly less than half of total ETF sales since December, it gives a good indication of how much gold stock there is left to supply to the market.

As the chart only provides data until end of May 2013 (and we've had another month of net sell-offs), current inventory levels are likely to be around 6-6.5 million ounces, e.g. they are at the same levels as they were in 2004.

This has several implications:

As mentioned in a previous article, the gold price is not mainly determined by the sentiment of the American public, at least not in the long run. It is driven by wage inflation in Asia and other economies where people either do not trust the local banking system (India) or want to store their wealth in assets that are hidden from the eyes of the local authorities (China). Nevertheless, ETFs provide the residual demand and supply that gives the gold price extra volatility. American inflation is therefore not a requirement to support the gold price, but is the trigger that will reignite price momentum once it takes place.

The key question is, has the gold price reached a bottom, or is it close to forming a bottom?

As shown by the below table (courtesy of the World Gold Council), the only ones who have been net sellers in q1 2013 (the key players in driving the gold price down) are the aforementioned ETFs.

With industrial demand stable and all other sources of demand increasing, the key question then becomes, can the ETF sell-off continue?

The below chart is showing the inventory of gold in COMEX vaults, which is where many professional investors store their gold (courtesy of Bloomberg finance).

As seen from the chart, inventory reduction since December 2012 corresponds to 4.5 million ounces, or close to 140 tonnes of gold. Though this is slightly less than half of total ETF sales since December, it gives a good indication of how much gold stock there is left to supply to the market.

As the chart only provides data until end of May 2013 (and we've had another month of net sell-offs), current inventory levels are likely to be around 6-6.5 million ounces, e.g. they are at the same levels as they were in 2004.

This has several implications:

- A sell-off of the same magnitude in the next 6 months becomes impossible, as this will take ETF inventory levels to 0.

- A continued sell-off must therefore occur at lower volumes. It is therefore highly unlikely that prices will come much further down, as the market has been able to absorb the massive volumes supplied by the ETFs, with only modest price declines (yes, in my book, a 30% decline for a commodity with this magnitude of sell-offs of is modest)

- There is huge upside in gold once the sell-off is completed. As ETFs are momentum buyers (the public is always displaying herd mentality and are following the trend), they will return to gold once the prices stop dropping. It is key to note, that the market was clearing around the $1700/oz level before the ETF sell-off started.

As mentioned in a previous article, the gold price is not mainly determined by the sentiment of the American public, at least not in the long run. It is driven by wage inflation in Asia and other economies where people either do not trust the local banking system (India) or want to store their wealth in assets that are hidden from the eyes of the local authorities (China). Nevertheless, ETFs provide the residual demand and supply that gives the gold price extra volatility. American inflation is therefore not a requirement to support the gold price, but is the trigger that will reignite price momentum once it takes place.

Sunday, June 30, 2013

Dollar collapse....finally?

The key dynamics of the most recent global macroeconomic paradigm (e.g. the last 40 years) can be summarized in a few points:

1. In 1971 the US dollar was taken off the gold standard, enabling America to issue unlimited quantities of new currency at will. The United States has been running a deficit on its balance of trade since then, accumulating debt to foreigners. In 40 years, the dollar has not once depreciated enough to allow for the trade-balance to turn into a surplus.

2. The early 1970s was also when China followed Japan, Taiwan, Hong Kong and others in adopting an economic growth strategy based on exports, mainly to the United States. The main component of the strategy was having their central banks matching cash flows from the exports of goods with purchases of financial assets in the United States (e.g. government bonds) to avoid their currencies from appreciating (which would hurt the exports).

3. The impact on the US and Asian economies of the above policy choices has been two-fold:

(i) Asian central banks placing their dollars balances drove the 30 year bull-run in the market for government bonds, pushed yields below levels needed for the preservation of the purchasing power of money invested, helped creating the US asset bubble in housing, as well as pushed up US stock market valuations. Currently, total financial assets held by foreigners amount to more than 9 trillion dollars, nearly 2/3rds of all government debt and almost 60% of US GDP.

(ii) Avoiding appreciating domestic currencies required the Asian central banks to issue new currency to pay for the dollars that were bought. As the proceeds from exports went to domestic producers who redeployed it in the economy, the policy resulted in increasing the domestic monetary supply, creating significant inflation and massive credit expansion in Japan in the 1980s (leading to the largest asset bubble the world has ever seen), and massive inflation and credit expansion in China in the last decade (and another huge asset bubble, the full consequences are yet to be seen).

Now, all that's in the past. How much longer can the current paradigm be extended, e.g. what about the future?

It is highly relevant to note that the two economies that have played the largest role in supporting the value of the dollar for the past 40 years currently are in the process of experiencing dramatic economic reversals, which are directly related to the long-term consequences of their past policy choices.

After a decade of deflation, Japan has recently resorted to a policy of hyper-aggressive monetary and fiscal expansion ("Abenomics"), aimed at stimulating the public to spend and invest as their cash holdings will yield negative returns when inflation increases. This policy has sent the currency down 20% vs the dollar, boosted consumer spending (+3.5%) and stock market valuations (up 55% for the year).

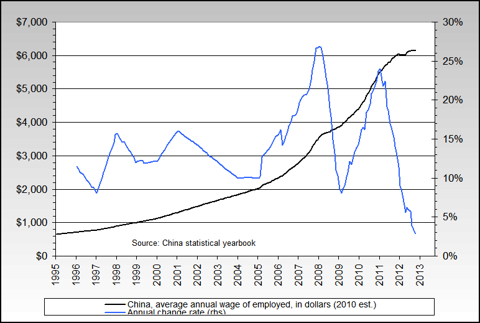

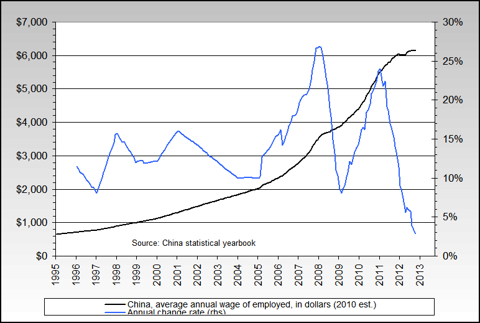

China's domestic inflation problems have eroded the competitiveness of Chinese producers, as dollar denominated wages have doubled between 2008 and 2013 to currently averaging around $8000 p.a., nearly 20% above wage levels in for example Mexico. Simultaneously, the shadow banking system, which has managed the majority of Chinese savings, is collapsing due to falling real estate valuations, implying China is going from rapid credit expansion to rapid credit contraction. Money is being pulled out of the shadow banking system and invested into gold and other assets that still allow an escape from the tax man, a major factor contributing to China becoming the largest buyer of gold globally in the first quarter of 2013.

In other words, Japan has already stopped supporting the dollar. With its domestic sector collapsing, China is becoming even more dependent on exports for growth, and is likely to continue with asset purchases in the United States off-setting export cash flows, whilst pursuing aggressive domestic monetary policies to bail out it's banks (like Japan did in the 1990s).

1. In 1971 the US dollar was taken off the gold standard, enabling America to issue unlimited quantities of new currency at will. The United States has been running a deficit on its balance of trade since then, accumulating debt to foreigners. In 40 years, the dollar has not once depreciated enough to allow for the trade-balance to turn into a surplus.

2. The early 1970s was also when China followed Japan, Taiwan, Hong Kong and others in adopting an economic growth strategy based on exports, mainly to the United States. The main component of the strategy was having their central banks matching cash flows from the exports of goods with purchases of financial assets in the United States (e.g. government bonds) to avoid their currencies from appreciating (which would hurt the exports).

3. The impact on the US and Asian economies of the above policy choices has been two-fold:

(i) Asian central banks placing their dollars balances drove the 30 year bull-run in the market for government bonds, pushed yields below levels needed for the preservation of the purchasing power of money invested, helped creating the US asset bubble in housing, as well as pushed up US stock market valuations. Currently, total financial assets held by foreigners amount to more than 9 trillion dollars, nearly 2/3rds of all government debt and almost 60% of US GDP.

(ii) Avoiding appreciating domestic currencies required the Asian central banks to issue new currency to pay for the dollars that were bought. As the proceeds from exports went to domestic producers who redeployed it in the economy, the policy resulted in increasing the domestic monetary supply, creating significant inflation and massive credit expansion in Japan in the 1980s (leading to the largest asset bubble the world has ever seen), and massive inflation and credit expansion in China in the last decade (and another huge asset bubble, the full consequences are yet to be seen).

Now, all that's in the past. How much longer can the current paradigm be extended, e.g. what about the future?

It is highly relevant to note that the two economies that have played the largest role in supporting the value of the dollar for the past 40 years currently are in the process of experiencing dramatic economic reversals, which are directly related to the long-term consequences of their past policy choices.

After a decade of deflation, Japan has recently resorted to a policy of hyper-aggressive monetary and fiscal expansion ("Abenomics"), aimed at stimulating the public to spend and invest as their cash holdings will yield negative returns when inflation increases. This policy has sent the currency down 20% vs the dollar, boosted consumer spending (+3.5%) and stock market valuations (up 55% for the year).

China's domestic inflation problems have eroded the competitiveness of Chinese producers, as dollar denominated wages have doubled between 2008 and 2013 to currently averaging around $8000 p.a., nearly 20% above wage levels in for example Mexico. Simultaneously, the shadow banking system, which has managed the majority of Chinese savings, is collapsing due to falling real estate valuations, implying China is going from rapid credit expansion to rapid credit contraction. Money is being pulled out of the shadow banking system and invested into gold and other assets that still allow an escape from the tax man, a major factor contributing to China becoming the largest buyer of gold globally in the first quarter of 2013.

In other words, Japan has already stopped supporting the dollar. With its domestic sector collapsing, China is becoming even more dependent on exports for growth, and is likely to continue with asset purchases in the United States off-setting export cash flows, whilst pursuing aggressive domestic monetary policies to bail out it's banks (like Japan did in the 1990s).

Wednesday, June 5, 2013

Betting against Roubini

Nouriel Roubini recently came out with an article predicting gold prices to reach $1000/oz by 2015. He is not the only one being bearish. As a matter of fact, his views seem to be shared by an overwhelming majority of opinion leaders and investment banks.

For example:

Desjardins Economic Studies - target $1200

Commerzbank - target $1227

Bank of America Merrill Lynch - target $1200

Goldman Sachs - $1270

As mentioned in a previous post, even notorious gold bulls, like Jim Rogers and Marc Faber, have mentioned $1200/oz as a possible floor for the drop in the gold price.

So, will Nouriel "I predicted the financial crisis" Roubini be correct about his gold price predictions? The arguments he is providing can be interpreted as follows:

1. The serious geopolitical risk has subsided and Gold as a "fear trade" is loosing triggers

2. Inflation has remained low in spite of massive monetary easing

3. Gold earns no income

4. Interest rates will rise (increasing the alternative cost of holding no-income assets)

5. Central banks of more indebted nations (such as Italy) may need to liquidate their gold holdings

6. Gold has been over-hyped by conservative US politicians

Just like everything else coming out of Roubini, his analysis is highly superficial, and just in line with US mainstream view (sorry Nouriel, you were not the only one, and definitely not the first one "predicting the financial crisis").

That does not necessarily mean he is wrong about his prediction, though his arguments certainly are flawed (as I will elaborate on below). Price formation for investment assets (gold, stocks or real estate) is largely determined by mainstream's expectations about future prices. If a majority of market players expect the price to go to $1200/oz, then the price will go to $1200/oz, as buyers will stop buying anticipating the price decline, and sellers will continue selling as long as the current price is above the expected future price.

As expectations are concerned, the US and European public go in tandem, with Europe usually lagging US consensus views.

What US and European public opinion leaders seem to have ignored, is that the market for gold has undergone massive structural shifts in demand over the last 12 years, dramatically changing the dynamics of the market. In q1 2013 the US accounted for a measly 4% of global gold demand, and Europe for only 6%. China accounted for a whopping 33% of global gold demand, and India for 28% according to the World Gold Council, with other mostly emerging economies accounting for the rest. Furthermore, ETF demand was only 6% of total demand.

Do US commentators still think we are in the 1980s, when the US and Europe accounted for nearly 80% of global gold demand? Roubini certainly seems to think so; all of his arguments would hold true if that was the case.

But the fact still remains that with new supply of gold increasing only a few percentage points per year, the price of gold is overwhelmingly determined by Asian buyers. It is highly questionable how much they worry about US recession risk, US inflation- and interest rate expectations, and how much they listen to Ron Paul and other ultra-conservative US politicians. They are likely to be much more preoccupied with the preservation of their domestic purchasing power, local traditions, and increases in the price of gold in their domestic currencies (which, for example in Iran, has been astronomical due to hyperinflation, contributing to Turkey becoming the third largest gold buyer in q1 2013, as Iranians cannot buy directly due to the international trade embargo).

It is the Asian buyers who predominantly have driven a five-fold increase in the gold price since 2001. And they have bought more gold because they could afford to do so. For example, average dollar wages in China doubled from 2008 to 2013. And official inflation numbers in India averaged nearly 10%, unofficially estimated by some to be at least 5% points above that. As the informed reader will know, the gold price doubled over the same period. With the recent price decline, gold has never been cheaper for the Chinese and Indian public as measured by how much gold they are able to buy. Get it? The implication of this is so important that I will repeat it: For more than 2 BILLION PEOPLE, the price of gold is at an ALL TIME LOW!

And, unless prices resume their ascent, gold will become cheaper still. McKinsey and the Boston Consulting Group have both published reports projecting Chinese wages to reach close to $20,000 by 2030.

In the near term, with central banks in the US, Europe and Japan printing money like mad to stimulate their economies in response to economic declines primarily caused by increased competition from the emerging world, domestic spending and consumption is set to increase. This is likely to result in even more imports from Asia, further fueling wages in export oriented economies.

And the gold price? Once the sell-offs by the American and European public have subsided (perhaps in a few more months), gold will resume its long term surge. At end of this blog, I allow myself to express how thankful I am for the contributions of Roubini and other egocentric imbeciles addicted to media attention (Henry Blodget of CNBC - a big thank you to you as well!). They are helping to create a major sell-off in gold when the fundamentals for owning gold are the best in 30 years. Thank you. Thank you. Thank you.

For example:

Desjardins Economic Studies - target $1200

Commerzbank - target $1227

Bank of America Merrill Lynch - target $1200

Goldman Sachs - $1270

As mentioned in a previous post, even notorious gold bulls, like Jim Rogers and Marc Faber, have mentioned $1200/oz as a possible floor for the drop in the gold price.

So, will Nouriel "I predicted the financial crisis" Roubini be correct about his gold price predictions? The arguments he is providing can be interpreted as follows:

1. The serious geopolitical risk has subsided and Gold as a "fear trade" is loosing triggers

2. Inflation has remained low in spite of massive monetary easing

3. Gold earns no income

4. Interest rates will rise (increasing the alternative cost of holding no-income assets)

5. Central banks of more indebted nations (such as Italy) may need to liquidate their gold holdings

6. Gold has been over-hyped by conservative US politicians

Just like everything else coming out of Roubini, his analysis is highly superficial, and just in line with US mainstream view (sorry Nouriel, you were not the only one, and definitely not the first one "predicting the financial crisis").

That does not necessarily mean he is wrong about his prediction, though his arguments certainly are flawed (as I will elaborate on below). Price formation for investment assets (gold, stocks or real estate) is largely determined by mainstream's expectations about future prices. If a majority of market players expect the price to go to $1200/oz, then the price will go to $1200/oz, as buyers will stop buying anticipating the price decline, and sellers will continue selling as long as the current price is above the expected future price.

As expectations are concerned, the US and European public go in tandem, with Europe usually lagging US consensus views.

What US and European public opinion leaders seem to have ignored, is that the market for gold has undergone massive structural shifts in demand over the last 12 years, dramatically changing the dynamics of the market. In q1 2013 the US accounted for a measly 4% of global gold demand, and Europe for only 6%. China accounted for a whopping 33% of global gold demand, and India for 28% according to the World Gold Council, with other mostly emerging economies accounting for the rest. Furthermore, ETF demand was only 6% of total demand.

Do US commentators still think we are in the 1980s, when the US and Europe accounted for nearly 80% of global gold demand? Roubini certainly seems to think so; all of his arguments would hold true if that was the case.

But the fact still remains that with new supply of gold increasing only a few percentage points per year, the price of gold is overwhelmingly determined by Asian buyers. It is highly questionable how much they worry about US recession risk, US inflation- and interest rate expectations, and how much they listen to Ron Paul and other ultra-conservative US politicians. They are likely to be much more preoccupied with the preservation of their domestic purchasing power, local traditions, and increases in the price of gold in their domestic currencies (which, for example in Iran, has been astronomical due to hyperinflation, contributing to Turkey becoming the third largest gold buyer in q1 2013, as Iranians cannot buy directly due to the international trade embargo).

It is the Asian buyers who predominantly have driven a five-fold increase in the gold price since 2001. And they have bought more gold because they could afford to do so. For example, average dollar wages in China doubled from 2008 to 2013. And official inflation numbers in India averaged nearly 10%, unofficially estimated by some to be at least 5% points above that. As the informed reader will know, the gold price doubled over the same period. With the recent price decline, gold has never been cheaper for the Chinese and Indian public as measured by how much gold they are able to buy. Get it? The implication of this is so important that I will repeat it: For more than 2 BILLION PEOPLE, the price of gold is at an ALL TIME LOW!

And, unless prices resume their ascent, gold will become cheaper still. McKinsey and the Boston Consulting Group have both published reports projecting Chinese wages to reach close to $20,000 by 2030.

In the near term, with central banks in the US, Europe and Japan printing money like mad to stimulate their economies in response to economic declines primarily caused by increased competition from the emerging world, domestic spending and consumption is set to increase. This is likely to result in even more imports from Asia, further fueling wages in export oriented economies.

And the gold price? Once the sell-offs by the American and European public have subsided (perhaps in a few more months), gold will resume its long term surge. At end of this blog, I allow myself to express how thankful I am for the contributions of Roubini and other egocentric imbeciles addicted to media attention (Henry Blodget of CNBC - a big thank you to you as well!). They are helping to create a major sell-off in gold when the fundamentals for owning gold are the best in 30 years. Thank you. Thank you. Thank you.

Sunday, May 19, 2013

No inflation yet? Wait and see.....

For those disappointed about the continued absence of substantial US price inflation, it is beneficial to recap a little bit of Economics 101.

Below is one a classic piece of economic analysis, courtesy of Wikipedia.com. It is called the Philips curve, after the economist who invented it. This particular chart is plotting the relationship between Unemployment and Inflation (a proxy for the latter is Rate of Change of Money Wage Rates), for the United Kingdom every year between 1913 - 1948.

In short, the Philips curve states that high unemployment in an economy corresponds with low inflation, and vice versa. There has since Philips published his work been numerous refinements of the theory surrounding the Philips curve, however, there seem to be broad agreement on the key principles behind it.

Simply put: When general unemployment is above what economists define as the equilibrium unemployment rate, wage growth tends to slow, as the unemployed are competing for jobs. When unemployment is below, jobs are competing for the unemployed, bidding up wages.

What the equilibrium unemployment rate is for an economy is dependent on a range of different factors. Unemployment benefits, minimum wages, laws that regulate hiring/firing, general ease/difficulty of doing business, quality of labor in a work-force etc, are general factors influencing supply and demand for labor. Generally, the more efficient/ the less restricted the labor market is, the lower is the equilibrium unemployment rate. Labor market rigidities explain why for example Spain was experiencing material wage inflation when it had 10% unemployment, while similar unemployment rates in the US on average led to declining wages.

Several analysts have estimated the US equilibrium unemployment rate to be north of 6%. This is up from its long term average between 4-5%, and reflects that long-term unemployment in the US have left more people less employable.

Currently, the US unemployment rate is 7.4%. This is still well above 6%. Hence, there is still higher supply of deplorable labor than there is demand, and on average no sign of inflationary pressure in wages.

As Uncle Ben Bernanke has promised us that he will keep printing money until US unemployment reaches 6%, he will not stop until he creates inflation. At the going speed of unemployed being hired, this point should be reached in about 12 months time.

Below is one a classic piece of economic analysis, courtesy of Wikipedia.com. It is called the Philips curve, after the economist who invented it. This particular chart is plotting the relationship between Unemployment and Inflation (a proxy for the latter is Rate of Change of Money Wage Rates), for the United Kingdom every year between 1913 - 1948.

In short, the Philips curve states that high unemployment in an economy corresponds with low inflation, and vice versa. There has since Philips published his work been numerous refinements of the theory surrounding the Philips curve, however, there seem to be broad agreement on the key principles behind it.

Simply put: When general unemployment is above what economists define as the equilibrium unemployment rate, wage growth tends to slow, as the unemployed are competing for jobs. When unemployment is below, jobs are competing for the unemployed, bidding up wages.

What the equilibrium unemployment rate is for an economy is dependent on a range of different factors. Unemployment benefits, minimum wages, laws that regulate hiring/firing, general ease/difficulty of doing business, quality of labor in a work-force etc, are general factors influencing supply and demand for labor. Generally, the more efficient/ the less restricted the labor market is, the lower is the equilibrium unemployment rate. Labor market rigidities explain why for example Spain was experiencing material wage inflation when it had 10% unemployment, while similar unemployment rates in the US on average led to declining wages.

Several analysts have estimated the US equilibrium unemployment rate to be north of 6%. This is up from its long term average between 4-5%, and reflects that long-term unemployment in the US have left more people less employable.

Currently, the US unemployment rate is 7.4%. This is still well above 6%. Hence, there is still higher supply of deplorable labor than there is demand, and on average no sign of inflationary pressure in wages.

As Uncle Ben Bernanke has promised us that he will keep printing money until US unemployment reaches 6%, he will not stop until he creates inflation. At the going speed of unemployed being hired, this point should be reached in about 12 months time.

Wednesday, May 15, 2013

Portfolio up 40%. Some reflections.

The position which continues to disappoint in the model portfolio, is long gold. After having reached an intra-day low of $ 1321/oz on April 16th, only to rebound to reach intra-day prices of $1490/oz around May 3rd, it has now broken through the bottom of its 4 week trading range, signalling further short-term decline. Chartists will probably start seeing "head-shoulder" formations if the price reaches 1350 (which I expect it to do), creating further self-fulling expectations about price declines.

Furthermore, price declines now seem to be expected even among the most stubborn gold bulls, which have a history of impacting the buyers sentiment (Marc Faber has become more quiet after his predicted stock market crash did not materialize in April, and after he proclaimed gold was a good buy at 1600, only to see it becoming an even better buy at $1400/oz a few weeks later, Jim Rogers, recently proclaimed he has buy orders on gold all the way down to the $1100/oz mark. Previously, before the decline, he advocated $1200/oz as a possible floor).

Support from physical gold buyers is unlikely to show the same strength around a second dip, at least not retail demand. To use myself as an example, I was among those that took the opportunity to load up on physical metal right after the floor bottomed out in mid-April (my entry point was $1380/oz, to be exact). Now, I have less cash to deploy when a similar opportunity comes along again, and need even lower prices to engage. A similar rush to buy, with the $1400/oz mark in fresh memory of physical gold buyers, is unlikely to materialize unless gold falls to around $1250/oz.

Paradoxically, the fundamentals for owning gold have not been as good as they are now for as far as I can remember. South African cash cost for gold production is around the $1400/oz mark (with China, US other producers ranging between $900-1300/oz). Should the gold price fall to the $1250/oz mark, many of these will be in a lot of financial pain, impacting market expectations about supply, and thus both the sentiment of buyers and sellers. Not to forget (if at all possible) that all the major central banks in the world seem engaged in a competition about who can add most to their currency supply.

The long-ago expected (but still missing) trigger to revive the secular bull market in gold would be signs of inflation finally materializing in the US (as other economies experiencing substantial inflation, China, India, and Iran, who is buying via Turkey, have been the key buyers of gold).

With US un-employment still hoovering north of 7.4%, general inflation, as measured by the CPI, is unlikely to materialize at least for another 12 months, and will be subsequent to statistics showing sizable development in credit expansion, and increases in the velocity of money. Until this point is reached, the gold price is likely to go sideways, my guess is with a solid floor around $1150/oz, $1400 to form the upper range of the band.

Monday, April 8, 2013

Chinese Wage Inflation Will Eat Apple's Margins

Apple's (AAPL) Baseline Scenario is Negative Growth

Apple stock has had turbulent fall from it's all time high of $700 per share in September 2012. The share price has continued its decline throughout the first quarter of 2013, in spite of the company announcing record profits in January for q4 2012.

Apple is now valued at a trailing P/E multiple of just 7, when adjusting for the net cash position. A simple approach to valuing the company, using a Gordon Growth formula on 2012 Free Cash Flow ($ 41 billion) suggests that in order to justify the current valuation levels, growth must be 5% negative per year to eternity.

If you are familiar with this approach, skip to the next section of this article. If you have no idea what I am talking about, read on.

Using the Gordon Growth Formula to value equity on equity cash flows assumes that

V = FCF*(1+g) /(Ke - g)

where V is the current value of future cash flows to equity adjusted for current cash position, FCF is the current Free Cash Flow to equity, Ke is the cost of equity, and g the expected growth rate.

Solving for g yields (using rounded numbers for Ke, V, g)

g = ((V * Ke) - FCF/ (V + FCF) = (($300Bn * 8%) - $41Bn)/ ($300Bn + $41Bn) = - 5%

Assuming an expected inflation rate of 2.5%, this is a 7.5% real decline per year.

Both Increased Competition And Increased Production Cost Is A Superbearish Cocktail

In spite of annualized sales being up 18% year on year in the forth quarter of 2012, earnings per share have decreased (-0.5%), mainly due to gross margin erosion (38.6% vs. 44.7% just one year ago).

Corporate guidance is suggesting both lower sales and lower margin for the 2nd quarter of 2013, corresponding to about $ 9.3 billion in net profits (mid-range of guidance), which is a decline of roughly 30% on q2 2012.

Apple has a history of under-promising and over-delivering. Though this is a lot easier to do when things are going well, management guidance probably has a buffer baked into the numbers, which are due in the last weeks of April. Though certain analysts (Citygroup, Jeffries) are highlighting there is significant risk that Apple will come short of its own bearish guidance, it may be reasonable to expect actual earnings to be around 5% above corporate guidance.

However, it is without a doubt that in addition to sales cannibalization from Android devices, Windows equipped Nokia (NOK), and a revamped BlackBerry (BBRY) hand-set, continued margin erosion is inevitable.

The three most important factors driving the margin erosion are:

1. A shift in product mix towards lower margin products (the iPad mini, budget iPhone rumored to be due in June)

2. Expansion of sales in more price sensitive emerging markets, where Apple is lagging Samsung (EWY) and Nokia in sales and distribution

3. Higher production cost in China due to wage inflation

Of these three factors, the third is the most ignored and underestimated, and most difficult to control and predict for Apple management.

A Closer Look at Chinese Wage Inflation

Chinese real wages have almost doubled since 2008 (see below chart, courtesy of Itulip.com). This as a direct consequence of the aggressive quantitative easing policy undertaken by the US Federal Reserve, a gigantic (though now decreasing) US current account deficit vs. China, and the Chinese policy of keeping the yuan in a narrow trading range against the USD.

As QE3 is continuing, so will Chinese wage inflation. Foxconn, that manufacturers iPad, iPhone and iPod has over 1.2 million workers in China and is periodically experiencing workers unrest due to demands for higher pay. Earlier this year, reports emerged that Foxconn had halted new hiring at its factories in China.

It it worth noting that Foxconn reported record earnings for the 4th quarter of 2012, at $1.21 billion, a 5.6% increase on the previous year, but also that the increase came at the expense of a minor decrease of it's net profit margin (from 3.24% to 3.23%).

Moving Production to Other Low Cost Geographies Will Take Time And Effort

Among the company's top 800 suppliers, almost 400 are in China (below distribution of Apple's suppliers, courtesy of Chinafile.com)

As Foxconn operates global production facilities, a shift in production over time to lower cost geographies is likely to be expected.

Bank of America Merrill Lynch this week estimated that Mexico's labor costs are now 19.6 percent lower than China's. Foxconn has existing operations in Chihuahua City, Guadalajara, Reynosa and Tijuana, which can be used as base locations also to produce Apple products.

Though it is possible for Apple to shift production over time to other locations, it is a painfully slow process due to the sheer size of local operations and the complexity of the supply-chain. Besides keeping tight control on the quality of work and components (which requires extensive training of suppliers), a key requirement of the Apple supply chain is to make new products quickly enough after launch to meet consumer demand.

Chinese wage inflation will eat Apple's margins, for many years to come.

Apple stock has had turbulent fall from it's all time high of $700 per share in September 2012. The share price has continued its decline throughout the first quarter of 2013, in spite of the company announcing record profits in January for q4 2012.

Apple is now valued at a trailing P/E multiple of just 7, when adjusting for the net cash position. A simple approach to valuing the company, using a Gordon Growth formula on 2012 Free Cash Flow ($ 41 billion) suggests that in order to justify the current valuation levels, growth must be 5% negative per year to eternity.

If you are familiar with this approach, skip to the next section of this article. If you have no idea what I am talking about, read on.

Using the Gordon Growth Formula to value equity on equity cash flows assumes that

V = FCF*(1+g) /(Ke - g)

where V is the current value of future cash flows to equity adjusted for current cash position, FCF is the current Free Cash Flow to equity, Ke is the cost of equity, and g the expected growth rate.

Solving for g yields (using rounded numbers for Ke, V, g)

g = ((V * Ke) - FCF/ (V + FCF) = (($300Bn * 8%) - $41Bn)/ ($300Bn + $41Bn) = - 5%

Assuming an expected inflation rate of 2.5%, this is a 7.5% real decline per year.

Both Increased Competition And Increased Production Cost Is A Superbearish Cocktail

In spite of annualized sales being up 18% year on year in the forth quarter of 2012, earnings per share have decreased (-0.5%), mainly due to gross margin erosion (38.6% vs. 44.7% just one year ago).

Corporate guidance is suggesting both lower sales and lower margin for the 2nd quarter of 2013, corresponding to about $ 9.3 billion in net profits (mid-range of guidance), which is a decline of roughly 30% on q2 2012.

Apple has a history of under-promising and over-delivering. Though this is a lot easier to do when things are going well, management guidance probably has a buffer baked into the numbers, which are due in the last weeks of April. Though certain analysts (Citygroup, Jeffries) are highlighting there is significant risk that Apple will come short of its own bearish guidance, it may be reasonable to expect actual earnings to be around 5% above corporate guidance.

However, it is without a doubt that in addition to sales cannibalization from Android devices, Windows equipped Nokia (NOK), and a revamped BlackBerry (BBRY) hand-set, continued margin erosion is inevitable.

The three most important factors driving the margin erosion are:

1. A shift in product mix towards lower margin products (the iPad mini, budget iPhone rumored to be due in June)

2. Expansion of sales in more price sensitive emerging markets, where Apple is lagging Samsung (EWY) and Nokia in sales and distribution

3. Higher production cost in China due to wage inflation

Of these three factors, the third is the most ignored and underestimated, and most difficult to control and predict for Apple management.

A Closer Look at Chinese Wage Inflation

Chinese real wages have almost doubled since 2008 (see below chart, courtesy of Itulip.com). This as a direct consequence of the aggressive quantitative easing policy undertaken by the US Federal Reserve, a gigantic (though now decreasing) US current account deficit vs. China, and the Chinese policy of keeping the yuan in a narrow trading range against the USD.

As QE3 is continuing, so will Chinese wage inflation. Foxconn, that manufacturers iPad, iPhone and iPod has over 1.2 million workers in China and is periodically experiencing workers unrest due to demands for higher pay. Earlier this year, reports emerged that Foxconn had halted new hiring at its factories in China.

It it worth noting that Foxconn reported record earnings for the 4th quarter of 2012, at $1.21 billion, a 5.6% increase on the previous year, but also that the increase came at the expense of a minor decrease of it's net profit margin (from 3.24% to 3.23%).

Moving Production to Other Low Cost Geographies Will Take Time And Effort

Among the company's top 800 suppliers, almost 400 are in China (below distribution of Apple's suppliers, courtesy of Chinafile.com)

As Foxconn operates global production facilities, a shift in production over time to lower cost geographies is likely to be expected.

Bank of America Merrill Lynch this week estimated that Mexico's labor costs are now 19.6 percent lower than China's. Foxconn has existing operations in Chihuahua City, Guadalajara, Reynosa and Tijuana, which can be used as base locations also to produce Apple products.

Though it is possible for Apple to shift production over time to other locations, it is a painfully slow process due to the sheer size of local operations and the complexity of the supply-chain. Besides keeping tight control on the quality of work and components (which requires extensive training of suppliers), a key requirement of the Apple supply chain is to make new products quickly enough after launch to meet consumer demand.

Chinese wage inflation will eat Apple's margins, for many years to come.

Labels:

AAPL,

Apple,

BBRY,

BlackBerry,

China,

EWY,

GOOG,

Google,

margin erotion,

NOK,

Nokia,

Samsung

Saturday, March 30, 2013

Portfolio up 30% since November

My position in BAC, GOOG and AAPL are moving in the right direction, though gold keeps under-performing (will probably not see any positive movement here until mid-2014).

Tuesday, March 26, 2013

Cyprus - chapter one of the Great Unwind

Yesterday, it was announced that Cyprus has stricken a deal with the Troika on how to secure financing for its banks. The proposal implies the bankruptcy of the country's second largest bank (Laiki), and government confiscation of un-insured deposits (though only 35% of these for Bank of Cyprus, the country's largest bank).

Good news of bad news? Does it matter in the end? Its just news.

What is happening in Cyprus is a gunshot in the air. The EUR 5 billion the Troika refused to finance are peanuts compared to the 240 billion that Greece has already received, the 68 billion received by Ireland, the 78 billion received by Portugal, or the 100 billion received by Spain. It is a sign to Italy that any Italian bailout will be on tough conditions, after all, why should Italy be treated better than Cyprus? Furthermore, a looming economic disaster is France, who's external debt position in increasing and increasing, likely to produce a crisis within two years on the current economic trajectory.

A more interesting question is, why (except for within extremist parties) is there no wide-spread recognition of the need to dismantle the Euro? Countries like France (which still have not reached the extreme un-employment levels of Spain) or Italy (which has a surplus on its current account balance) still have a chance to avoid an even bigger disaster in the future if they act now.

Dis-mantling of common currency areas have been done many times without any major difficulties (the break-up of the Soviet Union is a recent example). What makes the situation different in the Euro area are the extreme amounts of external debt held by each country. However, if debt holders take a hair-cut through currency devaluation or a hard hair-cut, does it really make any material difference for them? Until these economies have been de-risked, they will struggle to find financing and as assets values continue to deteriorate, trigger capital flight from the periphery to the center.

Capital controls are inevitable regardless of a euro de-peg. Capital will seek to fly if the country stays within the Euro (banks perceived as risky) or if there is the chance of a de-peg (devaluation). International coordination with European governments and central banks are the remedy in either situation.

It is in the interest of everyone to stabilize the periphery as soon as possible, and a currency devaluation might be the preferred route to avoid overshooting as society disintegrates in the periphery and financial bubbles are created in the center.

It continues to puzzle me that politicians still have not realized that what is happening in these countries is Europe's version of the Great Depression. The main challenge during the Great Depression was the Gold Standard. Cyprus, Spain etc have the Deutschmark standard, which is more or less the same thing.

The Great Depression did not end until all countries affected left the gold standard, which allowed them to debase their currency. The UK left the gold standard in 1931, the US held on until 1933. In the process, the US confiscated public gold, which is the same what has been happening in Cyprus, with politicians confiscating Euro's held by depositors. Subsequent research on the Great Depression documents that the earliness with which a country left the gold standard reliably predicted its economic recovery.

Do we need a major breakdown of society, with rise of political extremism, hunger, and social unrest before one realizes the need to dissolve the Euro? Or can it be done in a planned manner that preserves the value of existing economic structures of society and minimizes volatility?

Probably the Euro will live on for another 7-8 years. With the next bubble forming in German real estate.

Good news of bad news? Does it matter in the end? Its just news.

What is happening in Cyprus is a gunshot in the air. The EUR 5 billion the Troika refused to finance are peanuts compared to the 240 billion that Greece has already received, the 68 billion received by Ireland, the 78 billion received by Portugal, or the 100 billion received by Spain. It is a sign to Italy that any Italian bailout will be on tough conditions, after all, why should Italy be treated better than Cyprus? Furthermore, a looming economic disaster is France, who's external debt position in increasing and increasing, likely to produce a crisis within two years on the current economic trajectory.

A more interesting question is, why (except for within extremist parties) is there no wide-spread recognition of the need to dismantle the Euro? Countries like France (which still have not reached the extreme un-employment levels of Spain) or Italy (which has a surplus on its current account balance) still have a chance to avoid an even bigger disaster in the future if they act now.

Dis-mantling of common currency areas have been done many times without any major difficulties (the break-up of the Soviet Union is a recent example). What makes the situation different in the Euro area are the extreme amounts of external debt held by each country. However, if debt holders take a hair-cut through currency devaluation or a hard hair-cut, does it really make any material difference for them? Until these economies have been de-risked, they will struggle to find financing and as assets values continue to deteriorate, trigger capital flight from the periphery to the center.

Capital controls are inevitable regardless of a euro de-peg. Capital will seek to fly if the country stays within the Euro (banks perceived as risky) or if there is the chance of a de-peg (devaluation). International coordination with European governments and central banks are the remedy in either situation.

It is in the interest of everyone to stabilize the periphery as soon as possible, and a currency devaluation might be the preferred route to avoid overshooting as society disintegrates in the periphery and financial bubbles are created in the center.

It continues to puzzle me that politicians still have not realized that what is happening in these countries is Europe's version of the Great Depression. The main challenge during the Great Depression was the Gold Standard. Cyprus, Spain etc have the Deutschmark standard, which is more or less the same thing.

The Great Depression did not end until all countries affected left the gold standard, which allowed them to debase their currency. The UK left the gold standard in 1931, the US held on until 1933. In the process, the US confiscated public gold, which is the same what has been happening in Cyprus, with politicians confiscating Euro's held by depositors. Subsequent research on the Great Depression documents that the earliness with which a country left the gold standard reliably predicted its economic recovery.

Do we need a major breakdown of society, with rise of political extremism, hunger, and social unrest before one realizes the need to dissolve the Euro? Or can it be done in a planned manner that preserves the value of existing economic structures of society and minimizes volatility?

Probably the Euro will live on for another 7-8 years. With the next bubble forming in German real estate.

Labels:

Economic Convergence,

End of the Euro,

EURO dismantling,

EWY,

GLD,

Global Money Stock,

gold,

GOOG,

Google,

Inflation,

Investment strategy,

margin erotion,

monetary failure,

Monetary Policy,

ollapse

Monday, February 18, 2013

Appropriate asset strategies for inflation

What assets will appreciate faster than inflation in a high-inflation environment?

Certainly not stocks. Before inflation materializes, yes, but not when inflation has materialized. Inflation creates information inefficiencies, as corporate accounts become in-transparent, and it becomes very hard to see which company is profitable or not. Furthermore, due to high variability in prices, financial and operational planning becomes more difficult, tending to suppress investments. The real tax burden on companies increases, as profits become artificially inflated by timing differences. Finally, inflation will drive up interest rates, increasing the cost of capital for companies, making profits less valuable. In the inflationary period starting in the late 1960s (when Nixon was printing money to pay for Vietnam) the stock market was nearly flat until 1982 (though volatility was high), and corporate earnings increased less than inflation (average P/E multiples on the S&P 500 where in the range of 6-8).

Certainly not real estate. Cost of financing will increase, driving up required real estate yields and driving down valuations. As rents are adjusted with a time-lag, income from real estate asset will lag inflation. At current valuations (which in spite of the decline since 2008) house prices are still high in a historical context. Real estate will be worse investments than common stocks when it comes to preserving wealth. In the period up to when inflation materializes and interest cost adjust (which is what is happening now, foreseen to continue for at least 18 months) real estate will provide superior returns, but will be punished with a vengeance later on in the cycle. Back in 1978, my father paid for his first one-bed-room apartment with an amount corresponding to 6 month salary (and he was an entry level manager at the time).

And (for the sake of completeness) certainly not bonds or T-bills. If you among the few who might wonder why, google the term "bond duration" and you will know.

So, what is left then? Commodities? Farmland? Treasury Inflation Protected Securities???

Jim Rogers is a fan of the first two. His thesis is that purchasing power will increase more in Asia, leading to Asians eating more meat, which will push up the price of grain and increase yield on land. And there is some truth to it. Commodities performed relatively well during the high-inflationary period of 1968-1982, only to get hammered in the 30 years thereafter.

Treasury Inflation Protected Securities (TIPS) may provide some support, as the existing ones will be bid-up, as their (already very low) yields are likely to become even lower.

The key to survival in a high inflationary environment lies in capital allocation decisions. The optimal strategy is:

1. Purchase real estate with low maintenance and running cost, leverage your purchase to the max, and fix the interest rate for as long as you can. This is an asset that you can live in, and if you have a wood-fired oven to keep you warm, you can always manage variable costs....

2. Allocate a percentage of your remaining portfolio to precious metals (suggest 35%). A lot of people out there are very bullish on silver due to a favorable supply/ demand situation (usage in electronics keeps increasing, but supply from silver mines keeps experiencing larger and larger production cost). Also, in the extreme case of a hyper-inflation environment, where precious metals take over as currency (yes Armageddonists, you will love this!), Silver is more practical than gold, as coins can be used for everyday purchases due to lower value. Silver, however, has higher transaction cost when you want to buy and sell it and requires more storage. I prefer gold to silver, though gold has been very overbought and mid-term price direction is uncertain.

3. Allocate a percentage of your remaining portfolio to shorting US treasuries with long duration (suggest 20%). There is huge upside in such as position, as bond values converge to zero, you will at least double your money. Just remember to keep re-investing proceeds, to maintain the same exposure all the time (doubling the nominal value of your cash might not be enough to give you inflation protection).

4. Allocate a percentage of your remaining portfolio to financial service stocks (suggest 40%), especially financial brokers arranging ETFs, those that have proprietary trading activities in equities and commodities, and do NOT have bond market making activities. Money will pour into commodities, ETFs for all kinds of real assets, in a rather headless fashion, and investment and commercial banks will skim the margins. The size of their balance sheets, equity under management etc should increase with the rate of inflation, and inflation will reduce impairment risk of assets. When inflation is killed (no risk of this next 5-8 years though) banks will be in a pile of pooh-pooh, as they will have allocated a lot of capital to intrinsically unprofitable investments. However, whoever comes after Helikopter Ben needs to have a plan no cause a collapse, and warning signs will be ample.

5. Producers of farmland equipment can also be a good play for the next 5 years. Large-cap farming equipment producers with low P/E ratios have the potential to be re-priced as growth stocks when the market overshoots. And there will be acquisition plays as larger producers swallow the smaller ones with borrowed money.

Certainly not stocks. Before inflation materializes, yes, but not when inflation has materialized. Inflation creates information inefficiencies, as corporate accounts become in-transparent, and it becomes very hard to see which company is profitable or not. Furthermore, due to high variability in prices, financial and operational planning becomes more difficult, tending to suppress investments. The real tax burden on companies increases, as profits become artificially inflated by timing differences. Finally, inflation will drive up interest rates, increasing the cost of capital for companies, making profits less valuable. In the inflationary period starting in the late 1960s (when Nixon was printing money to pay for Vietnam) the stock market was nearly flat until 1982 (though volatility was high), and corporate earnings increased less than inflation (average P/E multiples on the S&P 500 where in the range of 6-8).